Description of the DueSight ESG-rating methodology

Real estate investment managers ESG-benchmark - 2024 reports

- The benchmark report is based on the sustainability-related sections of the companies’ published annual reports. Some of the company reports used have been assured by a third party.

- The benchmark analysis covers selected topics—aligned with the ESRS structure—that multiple real estate investment organisations have assessed as material.

- The companies themselves have not influenced the analysis or scoring; however, they may request corrections only where there is a clear and demonstrable misinterpretation of the information disclosed in their sustainability reports.

- In some cases, the information assessed in the benchmark is described only briefly or at a high level in the reports, which may result in the analysis and scoring not reflecting it.

- If there is a discrepancy between the text and a table in a sustainability report, the analysis is based on the information presented in the table.

- Differences in companies’ business models inevitably mean that the overall benchmark score should not be compared across all participating companies; instead, the aim should be to identify closely comparable peers. In particular, differences in business models—and therefore in material sustainability risks—arise when a company is involved in real estate development, including new-build or renovation/construction projects.

- The scoring is cumulative, meaning that achieving a given score requires sufficient evidence meeting the criteria for the lower score levels.

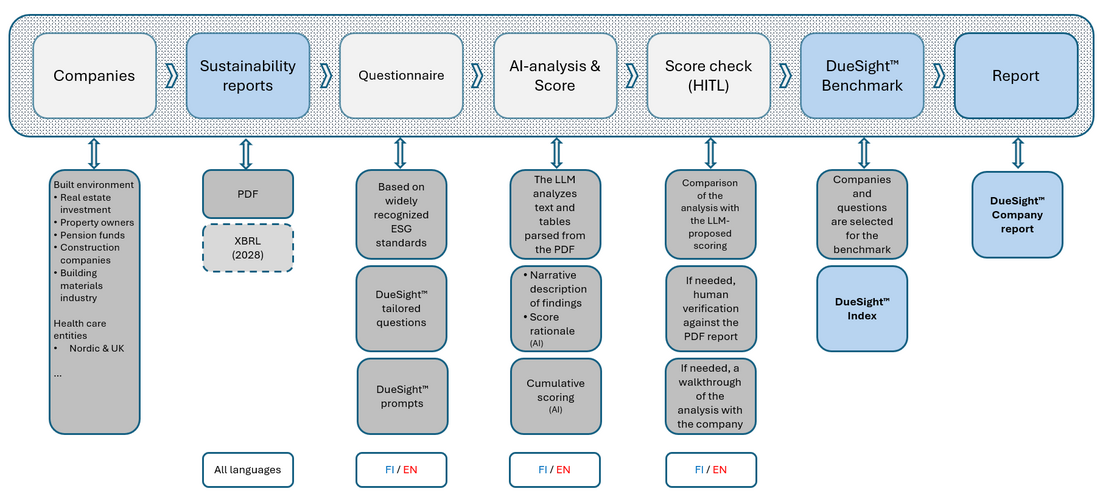

- The DueSight application is AI-assisted:

- an LLM searches the relevant texts and tables chunks for potential evidence against the criteria and produces a narrative analysis, which is stored. The LLM then performs an initial score assessment, after which an expert reviews the scoring, adjusts it where necessary, and documents the rationale for any changes (“human in the loop”).

- The ESG questions and their answers are unweighted; each response is assessed on a 1–5 scale. If needed, a comparison tailored to a company’s own strategic objectives through company-specific weightings can be produced as a separate assignment (for the commissioning company’s use only).

- The Real Estate Investment Manager ESG-Benchmark question titles, question text, and scoring criteria (prompts) are provided below in the attached PDF.

DueSIGHT general process

The REAL ESTATE INVESTMENT MANAGER ESG-BENCHMARK QUESTIONS AND CRITERIA

Each sector-specific benchmark will have its own set of questions and scoring criteria. Below are the DueSight questions for Real Estate Investment Managers.

Your browser does not support viewing this document. Click here to download the document.

Managing independence and conflicts of interest |

Delivery Conditions and Disclosure Policy |

|

Finreim is a limited liability company and a niche micro-enterprise; its responsible consultant is the founder of Finreim.

Finreim does not provide consulting services that would conflict with its ESG rating service. Excluded assignments therefore include, for benchmark-sector companies, drafting sustainability reports, providing assurance, carrying out CO₂ calculations, or other direct consulting aimed solely at improving the quality of a sustainability report. However, Finreim also operates as a consulting firm—for example, in the real estate and construction sector—and delivers client projects that are showcased on the Projects page. |

Benchmark analysis and the rating report are delivered only upon receipt of a written order / order confirmation (General Terms and Conditions for Consulting Services, KSE).

Finreim may publish on its website the names of the companies selected for the benchmark analyses, but will not publish the scores or ranking for public download. Use of the report and its correct interpretation require a meeting with the client to review the benchmarking methodology in order to understand the risks associated with the benchmark. |